3 Increasingly Popular Media Platforms Your Food Brand Should Investigate Right Now

The confluence of better technology and COVID-19 stay-at-home orders has caused new and improved media platforms to emerge, and they are experiencing unexpected growth. While some of these platforms were around prior to the pandemic, consumers now engage with available digital platforms more frequently to stay informed, entertained and educated. This presents a huge opportunity not only for service providers but also for food marketers who are looking to expand their audiences.

As the media landscape continues to fragment audiences, food marketers need to be sure they are considering these new avenues for their brand messaging. Here is a deeper look at three of the most enticing emerging media platforms. Each of these can present new opportunities for your food brand in the year ahead.

Streaming Services: COVID-19 Has Accelerated Streaming to Become the Present and Future of Content Creation

Streaming Services: COVID-19 Has Accelerated Streaming to Become the Present and Future of Content Creation

In the earliest days of the pandemic, TV viewership climbed as consumers turned to their trusted media for the latest news, entertainment and sports. However, digital usage increased even more. Since then, the use of social platforms and streaming services has risen almost everywhere, and we can expect some of these habits will continue.

Take, for instance, internet usage in the U.S. and the U.K. in April, where 73% of internet users between the ages of 16 and 64 were consuming more online video and music streaming due to the impact of COVID-19. And 65% of them were consuming more online TV and linear TV. And consumers are telling us they don’t expect to revert back to their old habits. Is this the new normal?

This year, consumers’ media habits have also changed across generations.

Among streaming-capable households, over-the-top (OTT) streaming accounts for 25% of collective time spent on TV. As viewers spend more time at home, they are increasingly hungry for more content. Consumers are more open to learning and discovering new technologies and content providers right now. Many homes have multiple subscriptions and screens to accommodate different household viewer preferences, and older audiences are streaming more, in part because of lifestyle changes, such as adults with families moving in with their parents.

With more time at home, a better understanding of new technologies and more choices of content available, streaming services have seen exponential growth. The array of services, whether paid subscriptions, with ads or without, appeals to all demographics. This includes consumers 55 and older, which historically is a sign of platform ubiquity.

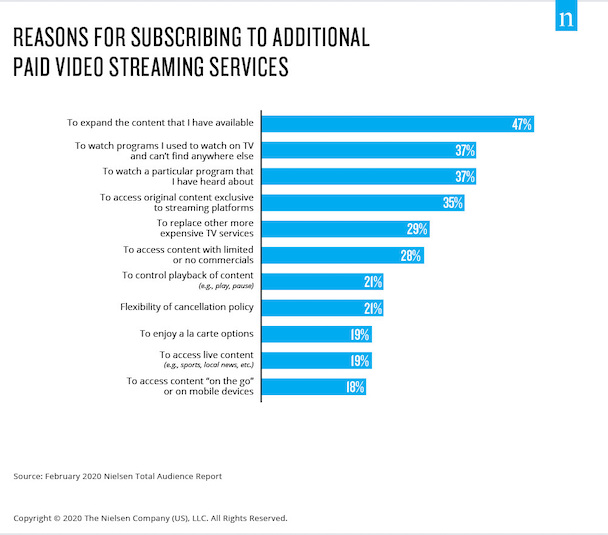

When we look at why people subscribe to streaming services, the top four reasons have to do with accessing more content. So, when it comes to planning your food brand’s streaming strategy, remember that content remains king.

OTT delivers precise targets for your food brand, whether you are targeting lifestyles, such as flexitarians, or shopping habits, such as online e-grocery shoppers.

For food advertisers, supplementing linear TV with increased streaming digital options has become a necessity, in order to deliver additional reach of the target audience. While TV allows for extensive reach and brand-building with entertainment, sports and news, OTT brings precise audience targeting via streaming services. Instead of buying media based on average viewership for a program, OTT allows targeting specific audiences with dynamic ad insertion to reach your best customers. The addition of OTT/digital further helps to extend the reach of the TV campaign and deliver households that may have been underexposed with linear TV as their only source of media.

Cable cord-cutting continues, and it is being replaced by streaming video-on-demand networks. The proliferation of on-demand services will continue to fragment audiences and media options as consumers search for new content and better pricing in the space. Audiences across the board stream every day, across multiple services; food advertisers need to stay vigilant in this evolving universe to extend their campaign reach to where customers are spending their time.

Image: alistdaily.com

Gaming Platforms: Tapping Into the Esports Market Where Top Food Brands Are Making Significant Investments

According to Dave Morgan of Simulmedia, “Gaming is emerging as not just the fastest growing media behavior among Americans, but as the next dominant tech platform, akin to what we saw in search starting 20 years ago and social over the past decade.” Proving his point, the esports global audience is exploding right now. A quick look at viewership shows that it has grown more than 11% to 495 million this year, and it’s expected to rise another 10.4% by 2023.

What is especially interesting about esports is its ability to transition its online fandom to live events. However, due to the pandemic, this year’s live events were either postponed or canceled. While this impacted revenue streams, online participation continued to surge. Growth was especially prevalent on Twitch, a niche platform that tends to draw younger audiences who are harder to reach through traditional platforms like linear TV.

According to the platform’s tracking system, TwitchTracker, COVID lockdowns caused people to increase their time on Twitch. That equated to more than 959 billion minutes (and counting), versus 660 billion minutes in 2019. Similarly, there are currently 6.5 million monthly streamers on Twitch, compared to 3.64 million in 2019.

This explosion in interest has increased the industry’s revenue and propelled esports into the spotlight for advertiser consideration. Food brands can take advantage of numerous opportunities, including sponsorships, logos on team uniforms, ads during TV sports and/or ads on team and league social media pages. As Twitch’s parent company, Amazon Advertising sells video and display ads on their digital platform, thus targeting the platform’s rapidly growing users.

Food brands who aren’t yet considering this channel should consider taking advantage of this dynamic and highly engaged audience.

One example to check out is the fast-casual chain Chipotle Mexican Grill, which recently featured a session with famous skateboarder Tony Hawk.

It is the first time the fast-casual chain has named a menu item after a celebrity, and the Tony Hawk Burrito was made using the athlete’s favorite ingredients. With the click of a button, the first 2,000 Twitch users who ordered the item on the brand’s app or website unlocked a special livestream preview of Activision’s “Tony Hawk’s Pro Skater 1 and 2” game. In addition, the three partners gave away 5,000 burritos to further ramp up the excitement. This promotion perfectly matched Chipotle’s core target audience of customers 24 to 35 years old with Twitch’s platform user base.

Podcasts: Food Marketers Are Reaching Engaged Audiences With Rich and Varied Content That Empowers Multitasking Listeners

The audio space has seen massive growth in the past few years, and there is no sign of that slowing down post-COVID. Amid the various media options available, 83% of consumers say they’re listening to as much or more radio as they were before the pandemic. Catering to this audience, new podcasts are being launched while other publishers are expanding their footprint in the audio space in order to reach its hyper-engaged audience. The Interactive Advertising Bureau (IAB) projects that U.S. podcast advertising revenues will surpass $1 billion by 2021.

The steady rise in mobile phones is driving podcast usage, and it will continue to do so as the smartphone penetration rate surpasses 45.4%. This presents a ripe opportunity for food marketers, especially those looking to reach younger generations that currently represent a sizable portion of the total podcast audience. As the U.S. podcast audience looks to double in size by 2023, flexibility and variety are key features that will help fuel the growth of the medium.

Following COVID-19, the podcast space has transformed and grown as people seek more content focused on education, entertainment and utility. Based on consumer needs due to the pandemic, genres that gained a boost in listening include cooking, health, fitness, science, news, children-related content and home entertainment. According to Edison Research, even with disruptions caused by COVID-19 people continued to listen to their favorite podcasts.

Podcast audiences offer food brands the opportunity to target engaged consumers.

Podcasts, like radio, are portable and can be a constant companion when viewing a screen isn’t an option. That makes audio the media of choice while multitasking and during transit times (either in a car or public transportation). Smartphones are driving podcast engagement, as more than 36 million Americans now access podcast content this way. The heaviest podcast listeners are also most engaged when they’re away from home.

Podcasts are unique in that they are very intimate and informal. Podcast ad formats are either host-read or scripted. Listeners’ affinity for show hosts is as important for marketers as it is for show content. In fact, host-read ads drive more brand recall than non-host-read ads. However, be prepared to give the host free range to add their own creative slant on it. Usually, you provide the podcast host the main messaging points you want the audience to hear, but then it’s up to them to endorse it their way. With host-read, the messaging comes across more authentically to the listener. It also makes it easier for you to scale your campaign across different podcasts and allows for tailored messages that speak more directly to specific consumer targets.

When SweeTango apple growers launched their new campaign for its crunchy, sweet apple, they partnered with nine podcasts. The campaign targeted apple shoppers with an emphasis on millennial and Gen Z listeners. Podcast hosts’ endorsements aired both before and in the middle of episodes covering food and cooking, pop culture and entertainment, and interviews with public figures.

Streaming, Esports and Podcasts Will Continue to Experience Unprecedented Growth in the Foreseeable Future

COVID-19 helped to accelerate changes in the 2020 media landscape. Technologies and more time at home facilitated the unprecedented growth of these three platforms. In 2021, we will continue to see new technologies transforming the media landscape, with 5G next-generation connectivity further facilitating mobile usage and ease of access. Content will continue to drive demand, and streaming, esports and podcasts will continue to be powerful vehicles used to deliver it to consumers. Food brands should consider these growing platforms, where engaged audiences are showing up, in their marketing plans. Remember, it will only get harder to get in later.