Data Driven Television: What Food Marketers Need to Know to Make the Most of their TV Spend

With the television upfront season in full swing (i.e., the annual process where advertisers pre-book 50-60% of the total advertising budgets in advance of the television season), there has been much discussion about if this will be the year of the data driven television upfront. In other words, will this be the year that television is bought, guaranteed and tracked based on data most relevant to brands like sales instead of the typical age and gender demographics?

While data will likely play an even bigger part in the upfronts this year, we’re probably not completely there yet. However, there are several things that food advertisers can do right now to be more data driven with their television. Before we get to that, let’s start with some definitions to make sure the elements of Data Driven TV are clear. Then we’ll explain why Data Driven TV matters to food advertisers.

Television Terminology

The current television landscape consists of two main categories: Linear TV and Advanced TV.

Linear TV

The traditional definition of TV, which is live video delivered over the air or through established pay TV services (i.e., cable & satellite) viewed on a television set. With digital video recording devices (DVRs) like TIVO or those built into pay TV providers’ set top boxes, linear TV also includes time-shifted TV, which means TV that has been recorded and watched at a later date and/or time. Linear TV includes network, cable and syndicated programming.

Advanced TV

A group of TV elements including data driven linear TV, Over-the-Top (OTT) TV and Connected TV (CTV).

Data Driven Linear TV – A more precise approach to linear television that delivers audience-based advertising beyond just age and gender. Data driven linear TV brings together audience or purchase data with linear TV to optimize plans across networks and dayparts with a high concentration of specific audiences. For example, a CPG food brand might want programs with a high concentration of home cooks or loyal shoppers of a specific retailer. Data driven linear TV is available through networks like NBC and AMC as well as through companies like Ampersand and Simulmedia.

OTT TV – Premium long-form video content streamed over the internet that may or may not require users to subscribe to a traditional pay-TV service. There are two types of OTT content, Ad-supported Video-on-Demand (AVOD) and Subscription Video-on-Demand (SVOD).

- AVOD – These services include free platforms (also called FAST networks) like Fox-owned Tubi or Amazon-owned FreeVee and tiered, hybrid platforms like Hulu, Netflix, Disney+ and Paramount+. They charge a subscription fee in addition to serving ads.

- SVOD – This is a service that generates revenue by selling subscriptions to consumers. Only Apple TV+ is fully funded by subscriptions.

CTV – A TV set connected to the internet, including smart TVs and internet-enabled devices. Examples are Vizio or Samsung TVs, Amazon Fire TV Stick, Apple TV and Roku devices.

Why Data Driven TV Matters

There are four key reasons that Data Driven TV is important right now. They are:

- The shift in TV viewing patterns

- The evolution of OTT TV revenue sources

- The need for better understanding of reach (including incremental reach) and frequency

- The desire to understand TV return on investment.

Shift in Viewing Patterns

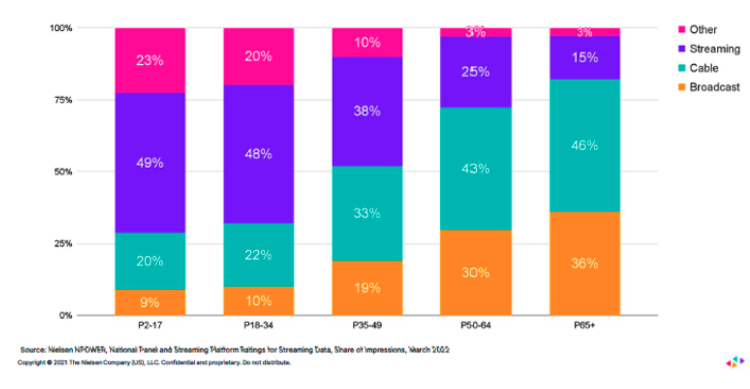

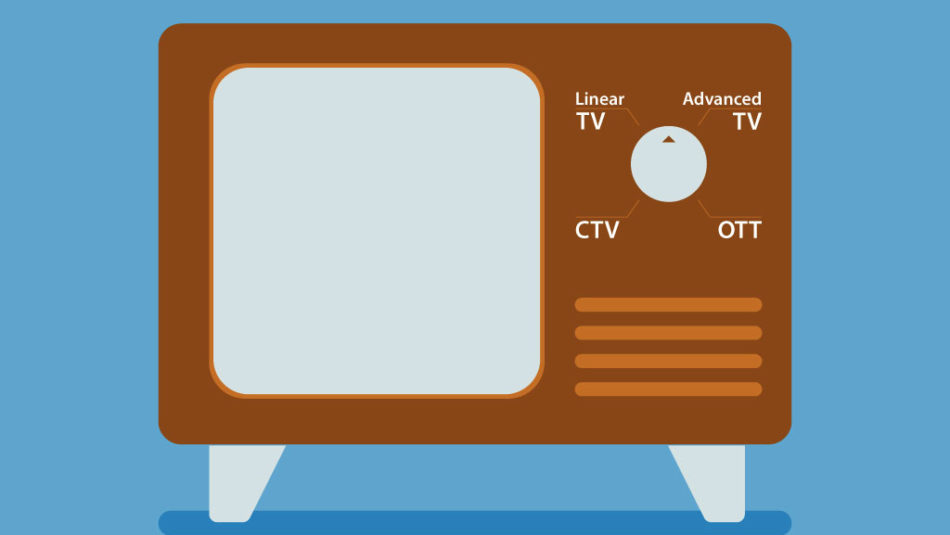

A monumental shift in viewing patterns happened during the pandemic lockdown. The combination of people being stuck at home with time on their hands looking for content to watch and production shutting down on network content led to streaming TV viewership taking off. Although the world emerged from the pandemic, and a lot has gone back to the way it was pre-pandemic, strong viewership of streaming is here to stay. As a matter of fact, based on the latest Nielsen Gauge Report, the streaming viewership has reached an all-time high share of viewing (41%), more than network viewing (22.6%) and cable viewing (26.1%).

Source: Nielsen Gauge, 9/24

Source: Nielsen Gauge, 9/24

The story is even more interesting when you break the data down by age group. For people under 35, streaming accounts for roughly half of their television use.

Need for Better Understanding of Reach (and Incremental Reach) and Frequency

Gone are the days when there were a manageable number of television options on a few broadcast networks and a handful of cable networks. According to a study by Gracenote included in Nielsen’s State of Play report, in June 2023 there were more than 2.7M unique program titles across U.S. traditional TV and streaming services, with many of those titles featuring hundreds of individual episodes and chapters. With this kind of choice available, television is highly fragmented, and building reach is a very difficult process. Utilizing a combination of linear and streaming TV platforms is necessary to gain any kind of sizable reach in television. Additionally, streaming is becoming much more important as people continue to cut their cable cord and only view television over the internet. According to eMarketer projections, the number of cord-cutters is estimated to grow 75% of all TV households (vs. only 20% of TV HHs in 2015).

Another important factor of reach is incremental reach. Because of the nature of television viewership, most impressions go to the heaviest viewers. For example, Samba TV did a study of Q4 2021 television ad campaigns and found that 97% of linear TV budgets for ad campaigns run during the quarter only reached 55% of linear TV viewers. So instead of hitting the same viewers with heavy frequency, finding incremental reach is crucial, especially incremental reach that’s efficient. With typically lower CPMs (although that is changing with increased demand) and the ability to reach viewers who do not watch Linear TV or are light viewers of Linear TV, adding streaming services to the buy makes a lot of sense.

Understand TV’s Return on Investment

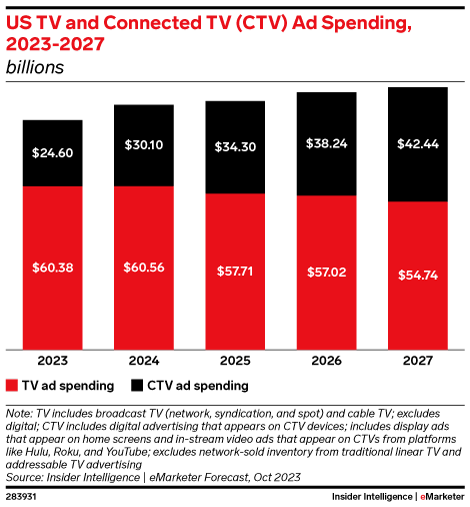

Digital media has seen huge gains in advertising spending, often at the expense of traditional media like television. The main reason for this is digital media’s ability to match actions taken by consumers to advertising they have seen. This is done through first- or third-party tracking cookies (or alternative IDs like The Trade Desk’s Unified ID 2.0 given that Google and Apple are eliminating cookies). These cookies can track what ad a user was served and what actions they took after seeing the ad (e.g., went to a product’s website, searched online for more information about the product, purchased the product online). With the digital nature of CTV, television can now be tracked just like digital media, and actions can be attributed to television advertising. This is a huge change and why according to an eMarketer October 2023 report, connected television expenditures are predicted to increase 40% between now and 2027, while linear TV expenditures are projected to go down 1o% during the same time period.

Source: eMarketer, October 2023

Source: eMarketer, October 2023

3 Things Food Marketers Can Do to Be More Data Driven in Television

- Ask your advertising agency what they are currently doing in the Data Driven TV space and their plans for the future.

-

- If they aren’t doing anything, push them to provide recommendations and develop a plan for how this will help build learning for the future.

- Set aside a small portion of your budget to try new data driven opportunities to gain learning.

-

- We typically recommend 10% of the TV budget be used to test new opportunities and gain learning. The small spend will pay off in exponential returns in future years.

- If you are participating in the upfront this year, explore expanding your mix to include streaming TV, and look at secondary guarantees beyond typical demographic guarantees.

-

- Every network presented linear and streaming capabilities together in this year’s upfront and are pushing packages to sell them together. Also, while networks, marketers and research vendors are not fully ready to embrace a guarantee based on marketing goals of a food company (i.e., sales or other attribution goal, not straight demographic), networks are willing to explore possible secondary guarantees if there is historical data for a few years to baseline their guarantee off of. So if you have this kind of data, it’s worth exploring with your key networks.

Wrap up

The amount of data available to marketers often feels like drinking from a firehose and how to make sense of the data can be overwhelming. At EHY, we’re experts at this and can help food marketers figure out how to make the most of their television budgets and ensure that they are getting the best return on this important investment.