Supermarkets in the Post-COVID World New Shopper Trends Impact Brick and Mortar

At the end of the movie The Candidate, Robert Redford turns to the consultant who just helped him get elected president of the United States and says, “What do we do now?” I think leaders in the supermarket industry probably feel the same way right now. With online grocery sales passing the $9 billion a month mark, doing something is mandatory.

Everyone knows that the pandemic has changed the way people shop for their groceries, but questions abound. How much of the new consumer behavior will fade over time, and how much will become permanent? How can the impact of pick-up in-store/home delivery on profitability be ameliorated? What are the ripple effects of the turmoil in the restaurant industry (10% of all restaurants closed permanently, struggle to find employees) on supermarkets?

Nobody knows the answers to all these questions. But here are a few interesting clues to how the industry is responding to these unprecedented times, and maybe a few ideas on ‘what you should do now’.

Technology to the Rescue

The sudden rise in online shopping spurred by the pandemic posed numerous challenges for the brick-and-mortar side of the supermarket industry. The accelerated growth rate of online shopping made integration of order fulfillment with traditional shopping critical but also very difficult. Retailers are now looking for ways to optimize what in some cases were ad hoc solutions made in a hurry.

- Walmart is planning to capitalize on the one big advantage it has over Amazon – a lot of stores. They are testing technology laden formats that speed up in-store pick rates for online orders, accelerating inventory movement, and experimental checkout technologies. While much of this effort is geared towards their dry goods offerings, their grocery business will benefit as well. At the test stores, pickers with hand-held devices have increased how often store associates find an item on their first attempt by 20%. John Crecelius, SVP for next-generation stores says of the test stores, “Their purpose is to find solutions that help our stores operate as both physical shopping destinations and online fulfillment centers in a way that has yet to be seen across the retail industry.” Walmart is also converting 1,000 stores to a format that uses the Walmart app and store signage to facilitate shopper journeys through the store, all ending with contactless checkout.

- Kroger continues to expand its partnership with Ocado to bring high tech to its fulfillment centers as well as in-store. They recently announced plans for an additional Customer Fulfillment Center to service the Southern region. The centers are 200,000 square feet and feature AI and state-of-the-art automation. Ocado learned its trade in the UK, one of the most competitive online grocery markets in the world. Kroger was attracted to their systems because they combine operating efficiencies that help lower cost while simultaneously delivering a superior customer experience in fresh food delivery. Ocado is also helping Kroger further develop in-store fulfillment capabilities.

- Sam’s Club has added to their Scan & Go app with a feature called Scan & Ship. It allows customers to scan a desired product and have it shipped to their destination, so they don’t have to deal with bulky items.

- Kroger is testing delivery via drone. Customers can place orders and expect delivery within 15 minutes. The drone will geo-locate the customer’s phone so delivery can be made to wherever the phone is. As an example, they offer a s’mores bundle with graham crackers, marshmallows and chocolate that can be delivered to a customer picnicking in a park. Kroger views this as just one part of their rapidly evolving $10 billion e-commerce business.

- Walmart is also looking at autonomous delivery vehicles, both ground based and drones. They have invested in self-driving vehicle company Cruise to aid in developing “a last mile delivery ecosystem that’s fast, low-cost and scalable,” said John Furner, Walmart CEO. The all-electric fleet powered by 100% renewable energy will also contribute to Walmart’s efforts to achieve zero emissions by 2040. In the air, Walmart is investing in DroneUp, an operator of small drones they partnered with last year in a test program. Walmart views drone delivery to be viable in the near-term. The fact that 90% of the population lives within 10 miles of a Walmart store gives Walmart a strong advantage in expanding drone delivery.

- Another Walmart test is HomeValet, allowing secure contactless home delivery. The temperature controlled smart box ensures groceries stay fresh. The smart box communicates with the driver’s device, giving them access to complete the delivery.

If You Can’t Beat Them, Join Them

The divisions between traditional supermarkets, online-only delivery start-ups, CPG companies and meal delivery companies continue to blur. Supermarkets are gearing up for a future in which online ordering, either for pickup or delivery, will become a critical part of their business. And they are not ignoring the opportunity to get into the prepared meal delivery market currently dominated by restaurants. Since ghost kitchens are showing success in this area, the thinking goes, why shouldn’t supermarket operators do the same? Several operators think the way to go is to buy the expertise rather than growing it in-house.

- Ahold, parent company of Stop & Shop, Giant and Food Lion, announced the purchase of FreshDirect last November. FreshDirect focuses on fresh food delivery in the New York area, with over 60% of their sales in perishable items. They partner with local farmers to provide customers with the best produce and also specialize in meal solutions.

- Kroger, in partnership with Kitchen United, is setting up ghost kitchens in several stores, with aggressive rollout plans. A Ralphs store in Los Angeles will be the first location, starting this fall, offering meals from various restaurants on one order. They can pick up in-store while they do their grocery shopping or have the order delivered. Walmart has a similar partnership with Ghost Kitchen Brands.

- Nestle, the world’s largest food manufacturer, is also getting into the meal delivery market, with the purchase of Freshly. They had bought a stake in the firm in 2017 to test the market. Apparently, they liked the results, having now bought the rest of the company. In 2020, Freshly delivered more than 1 million meals per week.

- Instacart is a conundrum for grocery stores. Customers like it, and it saves the supermarket time and money they would have to invest in developing their own delivery service. With the addition of Meijer, Instacart now offers delivery from 500 chains and 40,000 stores. This allows them to reach 85% of US households. But chains have strong misgivings about using Instacart, since it is not clear they end up making any money on the deliveries.

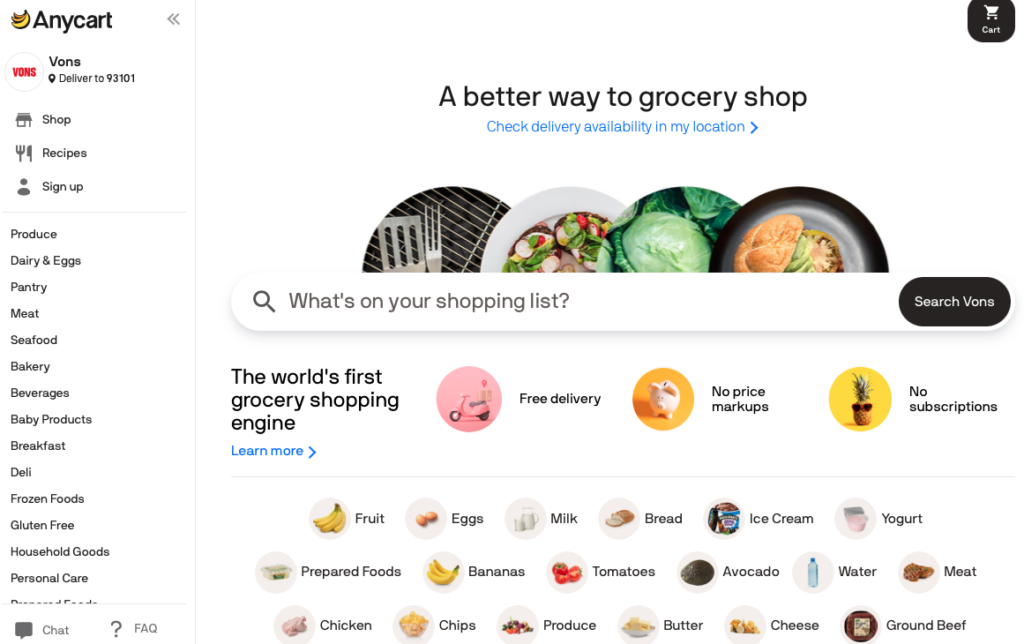

- A new startup called Anycart debuted in May, calling itself an online grocery shopping engine. The company offers delivery from local supermarkets with no markup or fees. They charge brands to advertise on the site, and featured supermarkets pay an affiliate fee. The site also offers recipe ideas and click-to-cart ordering of selected recipes.

- Farmstead uses a dark store model to deliver groceries in several cities across the U.S. By not being dependent on a traditional store, they can expand rapidly, deliver to neighborhoods with few traditional stores (so called “food deserts”), and do it profitably. Interestingly, they have also launched Grocery OS to help traditional grocers take delivery in-house.

- In March Albertsons announced that it has partnered with Google to improve customers’ experience with a range of AI innovations, including shoppable maps with dynamic hyperlocal features, conversational commerce and predictive grocery list building. Later this year, Google Maps will include information about online ordering from Albertsons stores directly within mobile search.

Hyperlocal Food

The pandemic has accelerated other trends besides online shopping. For example, food safety has become an increasing concern, and identifiable sourcing is one reflection of that. Locally grown produce is one way supermarkets are satisfying their customers’ desires and differentiating themselves from competitors at the same time.

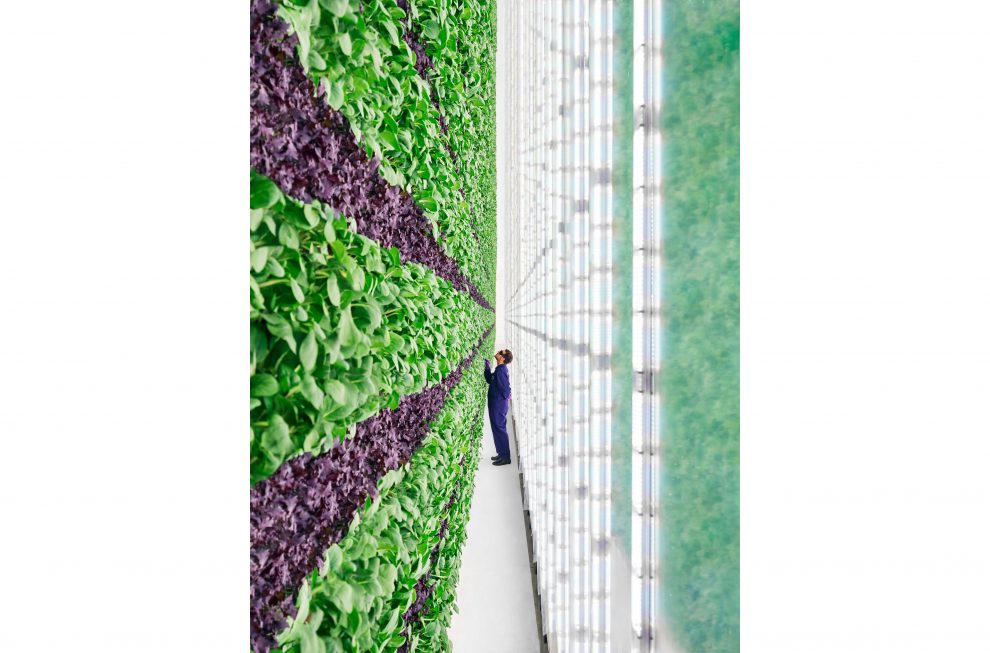

- Whole Foods in the UK has installed vertical farms in their stores. They use Infarm to build and manage these “farms”. Stores that can’t incorporate the farms will be supplied by Infarm’s nearby growing center, fulfilling the desire for hyperlocal produce.

- Meijer is helping to differentiate its small-format stores with up to 2,000 locally produced items on their shelves. They have partnered with RangeMe, an online product sourcing platform, to source and qualify local suppliers.

- In March, Safeway expanded Plenty, an indoor vertical farming produce supplier, into 17 more of their Northern California stores, bringing the total number of stores carrying Plenty produce to 53. The safety aspect of their process is a key advantage. “Our transparent growing process … lets us track a plant from seed to kitchen,” says Nate Storey, co-founder and chief science officer. Albertsons/Safeway plans to expand Plenty to more than 430 stores.

Finally, here’s a thought that might be a little out there, but who a few years ago expected drone delivery of groceries to be a thing ? Shopping on social media is expanding at break neck speed. It’s where the eyeballs are, and it provides frictionless shopping – you see the story, it sounds like something you might like and one click later you have bought it. Now there may be some challenges to doing the same thing with groceries, but it just might be the next answer to the question “What do we do now?”